Will 2020 Foreshadow a Boon in Rural Land Sales?

By Greg Fay, Founder/Broker, Fay Ranches, and Jeff Boswell of Republic Ranches

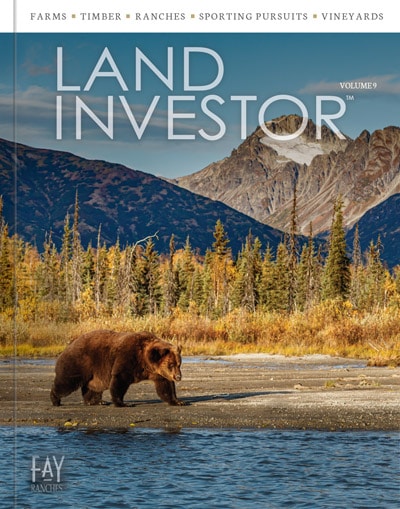

Virus-related lockdowns, economic devastation, prolific government spending, and social unrest have ushered in the new decade. Significant changes are happening at lightning speed, and trying to make sense of how this all ends is difficult and so far a bit counterintuitive. For families across the country, there is more uncertainty than ever. But interestingly, based on the unprecedented market for land over the summer months, it appears we are in the beginning stages of a bull market for farm and ranch sales in the U.S.

Under normal circumstances, oil dropping to under $0/barrel and unemployment spiking to over 10% would not favor rural land sales. When the lockdowns began, deal flow initially slowed down, with most people hunkering down and staying at home. As our communities began to reopen, there was a tremendous surge in interest in land investment. Fay Ranches and Republic Ranches agents and our competitors noticed the trend as investors looked at land as both the tangible and stable investment it has been for decades and a great, safe place to escape with their families. Now that we have had time to study this in-depth, we believe that we are seeing two significant impetuses for increasing rural land sales for the second half of 2020. This will likely continue into the coming years as more money shifts into land investment.

The first major shift is a migration from urban centers to more rural settings as families look for safety and social distancing while still enjoying their lives. People are realizing the tremendous value of being able to enjoy the outdoors away from others. More people are taking up hunting, fishing, camping, and other outdoor pursuits to pass the time and realize they really enjoy these hobbies. Nothing is stopping another pandemic from happening in the future, and if we learned anything this time, the best way to stay safe and healthy is to find distance from others while still doing things that make us happy and keep us sane.

The second shift is in investment strategy. At the beginning of the lockdown, almost everyone who had a second home on a ranch, at a beach, or just on some acreage moved there to get away from cities. Many are realizing they prefer it. With so little left to do in urban centers, those who did not have access to a home outside of the cities started wishing they did, which is one reason we have seen such an uptick in rural land and ranch sales.

Many companies have shifted to a work from a home model and quickly realized that their employees could successfully work from home while still being productive. This pandemic reshaped the way we, as a society, look at work structure. Not only do we have the tools and technology to work from home and still stay connected and productive, but potentially the operating costs for companies could be much lower if they continue some version of this in the future. The trend will likely continue on some level, giving employees more flexibility to move where they want, which these days tends to be towards suburban and rural areas. We foresee this trend and migration continuing for at least the next few years.

Another factor driving this demographic shift from urban to rural will be homeowners looking to avoid increasingly onerous city taxes as economic growth slows. As people move out of the city centers, it will aggravate city finances, which they will try to plug with even higher local taxes, as some large cities have already done. Cities will become less and less desirable to live in from an economic standpoint in addition to all the other factors at play.

Fear of future shutdowns will also play a role in land investment. Most people never imagined that the government would cut movement and economic activity the way it did. The continuing fear of COVID-19, or the next virus, could also spur people to look for less crowded living opportunities. Being in the country provides the ability to be outside and enjoy a healthier lifestyle. It also provides a sense of safety and security in the face of an unprecedented pandemic.

The most significant factor that may be spurring the trend will be financial. The amount of money being printed and spent by our federal, state, and local governments will put tremendous pressure on future taxes, economic activity, and likely inflation. Rural land investment is historically a sanctuary from inflation. Rural land is generally low taxed in most states because of agricultural exemptions, keeping carrying costs to a minimum. In times of turmoil, land is a tangible asset at little to no risk of losing all its value. Also, low-interest rates with expectations of coming inflation will mean making financial sense to go into debt now and pay back the loans with inflated money.

Many people report that the pandemic has offered them a special opportunity to spend much more time with their families. Rural land investment is a smart decision in these trying times, both from a financial standpoint and to provide you with peace of mind.

View Rocky Mountain Properties

The Benefits of Owning a Vineyard in the Columbia Valley AVA

Industry-leading viticulturist Dick Boushey performed a detailed site assessment of Dream Big Vista Vineyard, excerpts from which are reflected in this article. His full assessment is available on request. We know that investing in viticulture is a big decision and that location is everything to fulfill the financial success of your vineyard dream and […]

Jim Vidamour, Broker of the Year in Residential Land Sales

Fay proudly announces that Jim Vidamour, ALC, from its La Veta, Colorado, office, has been awarded the prestigious APEX 2023 Region 6 Broker of the Year in Residential Land Sales. This accolade was presented by the REALTORS® Land Institute (RLI) as part of the RLI APEX Production Awards Program, sponsored by The Land Report, during […]